Why the mini-bazooka is not enough to restore confidence in China’s economy – Shaun Rein

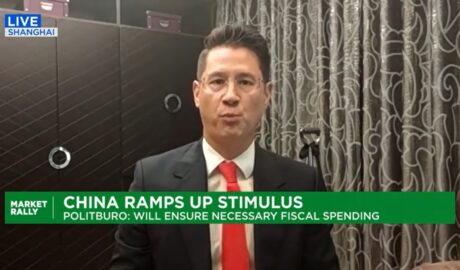

Business analyst Shaun Rein, author of The Split: Finding the Opportunities in China’s Economy in the New World Order, explains why China’s mini-bazooka will not help its economy in the long run. People need a serious fiscal stimulus, so they are confident about the economy again, he argues in a talk with David Lin. “People have to feel safe again before they are going to spend the money they made again,” he adds.Read More →