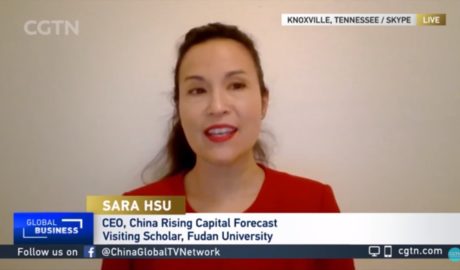

China: Not yet fully cashless – Sara Hsu

Cashless payments have become mainstream in China, but cash is still valuable and the government supports cash payments, says financial expert Sara Hsu, an associate professor at the University of Tennessee, specializing in supply chain management in the Guardian. A “[recent] directive pushes China’s policy of inclusive finance further to ensure that both elderly Chinese and foreigners can participate in economic transactions,” says Hsu.Read More →