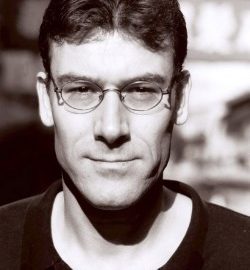

Delisting Chinese companies bad for US – Sara Hsu

The threat to delist Chinese companies from US stock exchanges has shocked observers, even though it is not yet clear whether the White House is moving forward. Financial analyst Sara Hsu warns the reputation of US financial institutions might be at stake. And also: her latest viewpoint on what the consumers might feel from the ongoing trade war.Read More →