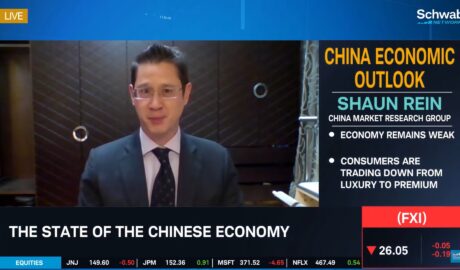

Why the equity market is wrongly shunning China – Shaun Rein

The equity market is shunning China, and especially Hong Kong, says business analyst Shaun Rein to the Schwab Network. But it is for the wrong reasons, as the economy is still bad, but slowly recovering, he says. Retail sales are going up, employment is improving and FDI is coming back in 2024, so reasons are enough to take those positive signs into account.Read More →