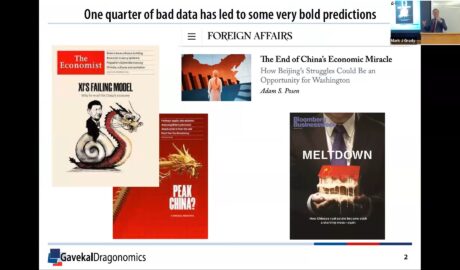

Can China deal with debts and property crisis? – Arthur Kroeber

China’s economy is dealing with some tough years, writes leading economist Arthur Kroeber, author of China’s Economy: What Everyone Needs to Know®, in ChinaFile, especially now that it does not have enough tools with debts and deflation like it did in the past. “So we need to brace for the consequences of the Xi model: slower growth in China, a big rise in Chinese technology exports, and more protectionism in the rest of the world,” he writes.Read More →