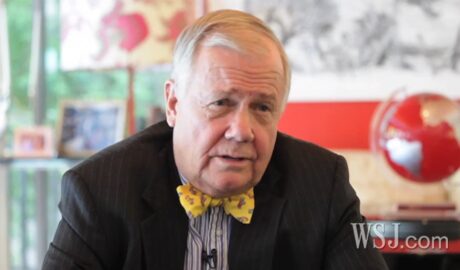

Why investors need different options, including China – Jim Rogers

Investors need to keep their options open, in case things go wrong, to have an alternative, including China, says Singapore-based American investor Jim Rogers at the Nomad Capitalist. “You hope you do not need it, but you need to have the option,” he says.Read More →