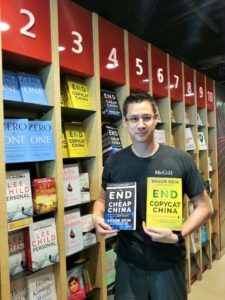

China is in the middle of a shift from the world´s factory to a base of innovation, argues author Shaun Rein of The End of Copycat China: The Rise of Creativity, Innovation, and Individualism in Asia. Silicon Valley and US firms in general should pay attention to that shift, he tells in the Mercury News.

The Mercury News:

Q: Talk to me about the changes that are afoot in the Chinese economy.

A: It would be a mistake for Silicon Valley companies and American companies in general to underestimate the rise of innovation in China. It’s true that over the past 30 years, China had mostly been a copycat nation. A lot of people have said it’s because the Chinese culturally can’t innovate or the government stifles innovation. Those were factors, but it was really concerns about intellectual property protection and a lack of funding for research and development that stopped innovation. And there was so much low-hanging fruit — either manufacturing something for export or copying something from the West — that you didn’t need to focus on innovation in order to get wealthy.

Now that the economy has changed and it’s getting harder to make money in China, a lot of companies are being forced to innovate just to survive. And what we’ve seen in the past six months is that some of the early innovators, like Tencent or Alibaba, have made a ton of money. That’s created a wholesale change among VCs and entrepreneurs. They’re now saying, “We can make more money by being innovative than by copying.”Q: What role have venture capitalists played in the shift?

A: Ten years ago, the VCs didn’t know how to operate in China. They were scared of the country. They would say, “Let’s invest in the Google of China or the Groupon of China.” They wanted to minimize risk and basically recreate what worked in the U.S. and back Chinese entrepreneurs who spoke English well. Now, in just the past two years, Chinese entrepreneurs have become VCs for the first time, and they’re looking to invest in innovation.

Q: Will Chinese entrepreneurs’ new approach help or hurt companies in the valley?

A: There’s a threat in the mobile space because some Chinese companies are light years ahead of what a lot of the players in Silicon Valley are doing. Many of the dominant players in Silicon Valley were made for a PC environment. When they shifted to mobile, they had to transport the experience, and the result wasn’t always great. In China, companies like WeChat (a messaging app) were built with the mobile interface from the very beginning because many Chinese have never accessed the Internet through a PC. You’ll find a security guard who makes $100 a month, and he’s accessing the Internet all day from his mobile device.

However, there are also great opportunities for Silicon Valley companies. Some Chinese tech companies that originally were copycats are cash-rich and looking to buy innovation by investing in and acquiring Silicon Valley and Canadian startups. And the valuation they’ll pay is often higher than an IPO.

Shaun Rein is a speaker at the China Speakers Bureau. Do you need him at your meeting or conference? Do get in touch or fill in our speakers´request form.

Are you looking for more innovation experts at the China Speakers Bureau? Do check our recently updated list here.