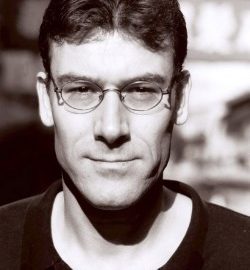

China’s rich now only go for top luxury brands – Rupert Hoogewerf

Previous darlings of the luxury industry like Louis Vuitton, Gucci, Omega, Versace and Hugo Boss are out of grace, as the country’s really rich focus on high quality, the real stuff, in stead of those parvenu brands. Hurun founder Rupert Hoogewerf explains in the China Daily what has changed.Read More →