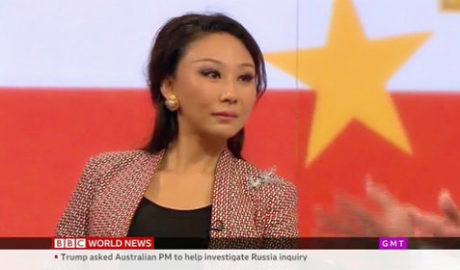

Cloudy skies for China’s local governments – Sara Hsu

Local governments in China have amassed an amazing amount of debt. Dropping revenue and disappointing economic performance is a major challenge, writes financial analyst Sara Hsu in the China-US Focus. “The outlook for local government financials is not positive.”Read More →