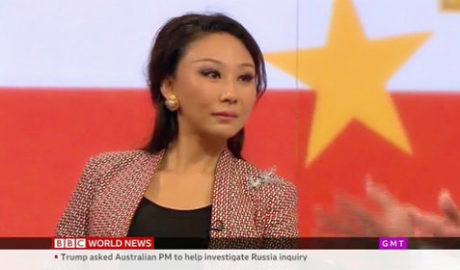

Why the Evergrande collapse did not happen – Sara Hsu

Almost half a year ago the real estate giant Evergrande started to fall apart under its 300 billion US dollar debts, but the collapse – expected by many – has not yet emerged. Financial analyst Sara Hsu explains in the Commercial Observer why this collapse has not happened.Read More →